SHIPPING: LOGISTICS & TRANSPORTATION

“Worldwide Demand for Palm Oil is Expected to Double by 2020”

United Nations Environment Programme (UNEP), 2012

DEZYRA SDN BHD exports, supplies, and distributes high quality Palm Oil to clients all around the world. Centralizing trading and marketing activities in one or a few locations allows companies to consolidate sources of supply so they can better manage and meet customer demand. With our determination and passion, together with overwhelming support from our business partners and clients, DEZYRA Sdn Bhd provides a one stop center for Palm Oil products.

We envisioned to be the market leader in shipping and transportation in Malaysia focusing on Palm Oil Industries. We help our customers manage and moving their physical requirements, all within an overall commitment to the development of long term relationships that benefit all parties. Having a presence on the ground is key to our approach to getting first hand information as it happens and sharing that information, quickly and efficiently.

Export Markets:

Major: China, India, EU, Pakistan, Middle East, US

Emerging: Russia, Eastern Europe, Kazakhstan

Importing: Indonesia, Papua New Guinea

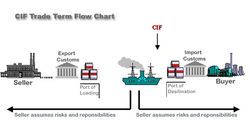

International Trade Terms & Flow Chart

When you are involved in importing into your country from a foreign country, you need to be familiar with key global trade market terms. In the import export glossary terms, there are two main categories, sales shipping terms and payment terms. Sales and shipping term defines how the goods importing from are logistically handled and how product liabilities are classified in the entire process of importing into your destination from the origin, i.e., Malaysia in this case.

On the other hand, payment terms define payment formats for the importing goods from Malaysia as well as when and how transactions are made in the process of importing from the origin to your destination on a contractual basis. All these global trade market terms will have legal biding. As importing and exporting involve product changing hands between two different parts of the world where banking financing and credit systems can be quite different, traditional domestic trade market terms such as pre-paid and cash on delivery are very difficult to enact.

As a results, a series of standardized international trade market terms became available to protect the interests of both importing and exporting parties. Obviously, the risk for an importing party will be a security for the exporting party. Therefore, when you are importing from country A into county B, you will always have to negotiate with the exporters in country B to reach mutually agreeable trade terms.

Exporter: Least Secure → Less Secure → More Secure → Most Secure

Payment: Open Account Bills for Collection Documentary Credit Advance Payment Importer: Most Secure ← More Secure ← Less Secure ← Least Secure

|  |

|---|---|

|  |

|  |

|  |

Main Types of Money Transfer - Market Terms Glossary

SWIFT Inter-Bank Transfer - now firmly established as standard practice in importing from one nation into the other. The importing party will instruct their bank to make payment to any bank account specified by the exporting party. So it would be good practice for the exporter to include their account details on their invoice heads.

Buyer's Check - unsatisfactory trade market terms of settlement for the exporter as it carries the risk of dishonor upon presentation as well as the added inconvenience of being slow to clear. There is also the very real danger of the check being lost in transit as well. A check is also unsatisfactory if it is in the currency of the buyer, as this will take longer to clear and will involve additional bank charges. Exporters only use this method if they have an established trading history with the importing party or in cases where the profit margin has been increased to offset cash flow problems anticipated by the delay in receiving payment.

Banker's Draft - this is arranged by the importing party who asks their bank to raise a draft on its corresponding bank in the exporting country. This term provides additional security to a buyer's check, but they can be costly to arrange.

International Money Orders - these are similar in nature to postal orders. They are pre-printed therefore cheaper to obtain than a Banker's Draft, although again there is the risk of loss in transit.